The latest answers to your questions

Coronavirus Relief Loan – The CARES Act’s Paycheck Protection Program (PPP)

We’re here to help keep you informed. Answers will be updated as new details become available based on guidance from the US Treasury Dept., the Small Business Administration, and lenders processing and issuing PPP loans.

- All Categories

- Application

- BoeFly

- Borrowers

- Fees

- Funding

- Lenders

- Loan

- Payroll

- Portal

- Taxes

- Technical

- Working Capital

- Loan Processing

- Banks

- Franchise

- Self-Employment

- Fund Depletion

PPP loan applications are only submitted to one BoeFly lender for consideration. If that lender is unable to process the application, we aim to pivot the application over directly to a different BoeFly lender. At no time will your application be sitting with multiple BoeFly lenders simultaneously.

Indication that an E-Tran number has been assigned to your EIN is good news. In all likelihood, your loan received SBA authorization by one of our bank partners (assuming BoeFly was the only other place besides your local bank where you submitted an application). All of BoeFly’s lending partners remain fully engaged in securing additional SBA authorizations; therefore, we haven't received the real-time updates that would enable us to specifically identify the lender that secured the E-Tran. As we receive information, we'll update your status on the Portal and advise you of the status change.

After your loan application is received by a bank, expect that funds will be disbursed within 10 business days of getting the formal SBA Authorization.

No. Despite the CARES Act stipulating a 10-business-day period between SBA approval and fund disbursement, many banks are struggling to process the volume they have within this time constraint. It does not mean you will not get your money. It means it just may take beyond those 10 business days.

Lenders are working diligently through their closing processes, but due to the heavy traffic and volume of loans, it is often taking them the full period of 10 business days. BoeFly is working with lenders to provide better insight into when borrowers, like you, should be raising their hands if they haven't yet heard from the bank.

Most likely, yes. Many of BoeFly’s lenders work with servicing partners to underwrite and process their PPP loan applications. As such, it is important that you take the actions prescribed in these emails so that your PPP loan can be funded. Many, if not most, of these emails will reference BoeFly so as to confirm they are working with us.

Once your loan has been assigned to a bank partner, you should expect that they will contact you directly or via one of their processing partners to handle the next steps.

First, congratulations that you are one step closer to obtaining your PPP loan! If you were one of the small businesses that did receive an approval notice, your lender will contact you directly to handle the next steps in coordinating disbursement of funds. An email will be sent directly from the bank with closing documents and directions on signing. Lenders have 10 business days to finalize the disbursement of loans.

In addition, your application status within the portal will shift from Lender Approved (Pending SBA Authorization) to SBA Approved.

Please do not contact the lender or BoeFly directly, as they are working as quickly as possible to finalize your loans. At BoeFly, our main focus right now is to get the loan applications to banks. Providing each applicant with the bank information that they’ve been assigned, prior to the lender contacting the applicant, would delay others.

BoeFly only partners with FDIC-insured banks and SBA-approved lenders from around the country that are able to distribute funds for the PPP loan application. If you want to learn more about the specific bank that is processing your loan, please visit their website for more information.

For PPP loans, BoeFly will only partner with FDIC-insured banks – search the FDIC Institution Directory here – and SBA-approved lenders, which their list of lenders is searchable by location. The bank that you are matched with could be in any location, as long as they fall into one of those two categories, meaning they are able to distribute funds for PPP loan application.

As BoeFly works to process loans for our applicants, we've experienced lenders responding with loan amounts below the total applicants have applied for. This is occurring as small business owners have calculated average monthly payroll differently than the lenders willing to process the loans. It also has occurred in instances where the average monthly payroll that the lender is able to verify based on the supporting documentation provided is different than the number presented on the application. We understand this is frustrating. The borrower will have to decide if they want to accept the funding amount or reapply.

- BoeFly will notify you via email that your loan application has gone to a bank.

- The applicant’s lender will contact the applicant to confirm approval or request additional information to process the loan. Please note that we do not know the time expected between our alert and when the applicant will be contacted by the bank.

- As part of that process, the lender may ask applicants to open an account at that bank to support the loan disbursement. In other cases, the bank will ask for additional information, consistent with their regulatory requirements while not requiring a new account to be opened.

- The bank will follow their own origination and closing process for your loan, including updates on your loan process.

- Expect that funds will be disbursed within ten days of getting the formal bank approval.

The most important documentation to ensure processing of your PPP loan request is appropriate payroll verification. A 2019 Full Year or Trailing Twelve Month CARES report from a payroll provider (e.g., ADP/Paychex/Other) is the ideal documentation for this purpose. If this is not available, then one of the following AND 2019 W-2s that support no individual payroll or employee payroll over $100,000 are required:

- Previous 4 quarterly IRS Form 941s or Annual 940

- Annual Tax Return (last year filed)

If you are a partnership, independent contractor, or a sole proprietor, then your 2019 Tax Return will be necessary.

If not already uploaded, absence of the following documents may have caused the lender flag:

- Articles of Incorporation or Bylaws

- 2019 Employer Paid Medical Benefits and any 401K Contributions

On occasion, lenders flag files for lacking 2019 payroll documentation despite it not being possible to provide (for example, if the company began in 2020). In cases like this, ensure the documentation provided is accurate, and upload an additional PDF document explaining why your file is complete as is.

In all instances where you've been notified that your file has been flagged, your application status within the portal will be adjusted to In Progress, which will allow you to recertify and resubmit your application with adjusted documentation. This will not adversely impact your loan status with the lender.

No, unfortunately. Due to the time constraints provided by the SBA, lenders are required to close your loan within 10 days of your SBA authorization, and therefore more time cannot be granted. If you do not want to proceed, please reply back to the bank that you are withdrawing your application.

Each lender will have a different system for processing PPP loans, which may or may not be automated and therefore may or may not allow for direct communication to ask questions or discuss individual loans. Information about this should be available from the lender upon their direct engagement.

As banks are processing loans, they have run into several instances where an individual loan has already been assigned an E-Tran authorization in SBA’s system by another lender. We have supported our applicants submitting their PPP applications with multiple lenders, and in some cases, E-Tran authorization has been assigned through an alternate bank, and they have not withdrawn their application from our BoeFly system. It is important to our lenders that we send through applications that have not been assigned an E-Tran authorization so that they can successfully process as many loans as possible during PPP2.

The majority of lenders can’t handle the high volume of loan applications, and this could delay getting you your money. Banks are unsettled and the pressure is intense on all parties, not to mention that banks are in crisis mode with COVID-19, just like you. BoeFly is continuing to work closely with both community banks and large national banks as they come online to process PPP loans. We process with an array of lenders of all sizes, working with those that can work with technology and are OK with the economics, showing that they are not avoiding the program.

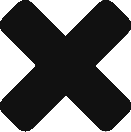

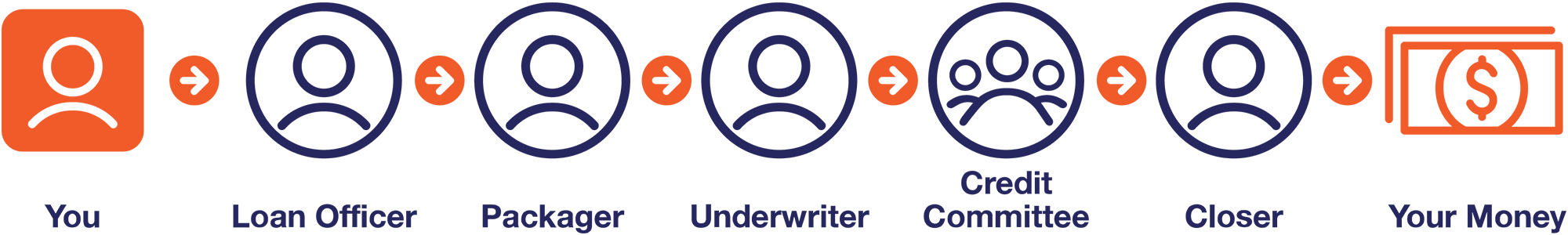

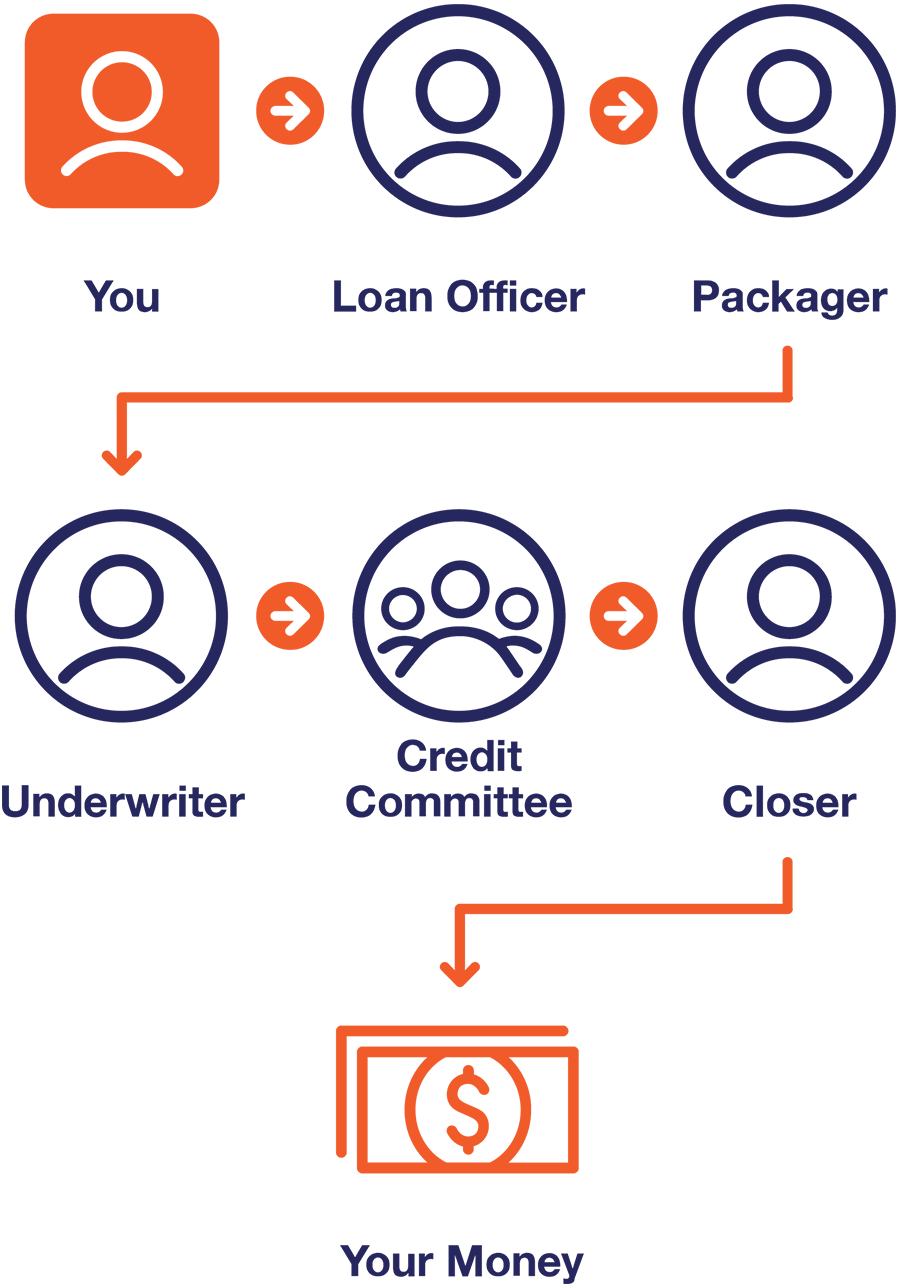

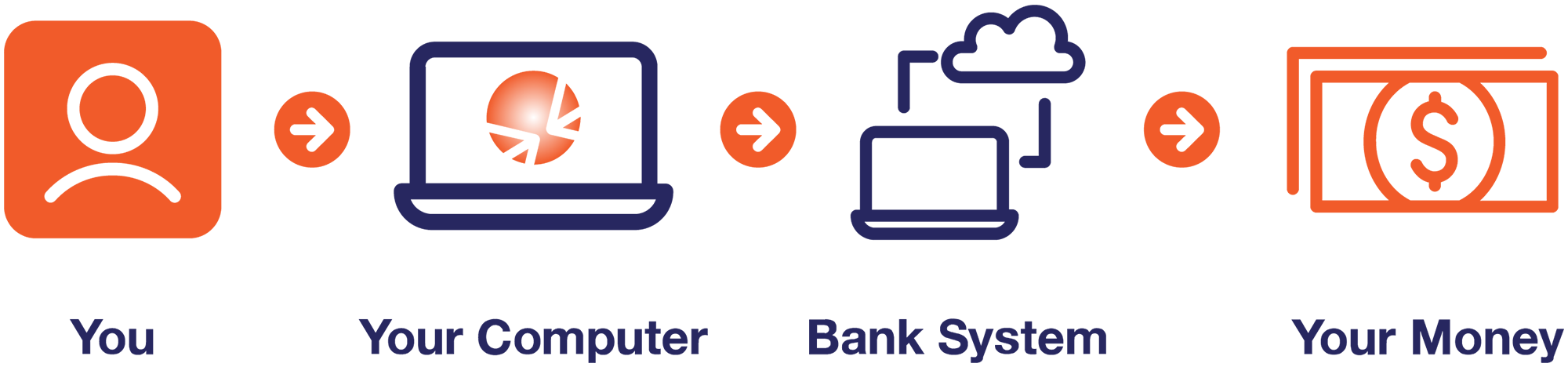

How banks execute will be critical.

Will banks use their 'normal process' relying on people and manual steps?

Will banks use the tech-driven process and focus on speed?

If you expect you will get a loan from a bank because you meet their criteria, you can still move forward with their process, and we’ll also keep processing for you unless you get your authorization elsewhere.

If you expect you will get a loan from a bank because you meet their criteria, you can still move forward with their process, and we’ll also keep processing for you unless you get your authorization elsewhere.

No. Providing an accurate calculation of payroll costs is the responsibility of the borrower, and the borrower must attest to the accuracy of those calculations. Lenders are expected to perform a good faith review, in a reasonable time frame, of the borrower’s calculations and supporting documents concerning average monthly payroll cost. The level of diligence by a lender should be informed by the quality of supporting documents supplied by the borrower. Minimal review of calculations based on a payroll report by a recognized third-party payroll processor, for example, would be reasonable.

If lenders identify errors in the borrower’s calculation or material lack of substantiation in the borrower’s supporting documents, the lender should work with the borrower to remedy the error.

No. It is the responsibility of the borrower to determine which entities (if any) are its affiliates and determine the employee headcount of the borrower and its affiliates. Lenders are permitted to rely on borrowers’ certifications.

Yes. Please direct the local bank to our lender’s page to submit their information and connect with BoeFly to learn more about how our technology can help them streamline their processing of PPP loans.