The latest answers to your questions

Coronavirus Relief Loan – The CARES Act’s Paycheck Protection Program (PPP)

We’re here to help keep you informed. Answers will be updated as new details become available based on guidance from the US Treasury Dept., the Small Business Administration, and lenders processing and issuing PPP loans.

- All Categories

- Application

- BoeFly

- Borrowers

- Fees

- Funding

- Lenders

- Loan

- Payroll

- Portal

- Taxes

- Technical

- Working Capital

- Loan Processing

- Banks

- Franchise

- Self-Employment

- Fund Depletion

PPP loan applications are only submitted to one BoeFly lender for consideration. If that lender is unable to process the application, we aim to pivot the application over directly to a different BoeFly lender. At no time will your application be sitting with multiple BoeFly lenders simultaneously.

All applicants can log into the portal to see their current status. Statuses are as follows:

Created

You have created your account, but have not reached the “In Progress” stage of your application.

In-Progress

Your PPP loan application is in progress. The next step is for you to complete the application and e-sign, at which point the status will change to “Submitted.”

Submitted

Applicant has completed their application, but it has not yet been submitted by BoeFly to a lending partner.

Lender Submitted

BoeFly referred your file to a lending partner, but as of now that bank has not approved the loan.

Lender Approved (Pending SBA Authorization)

A BoeFly lending partner has approved your loan and it awaits the SBA authorization process.

SBA Authorization (E-Tran Number) Secured - Pending Bank Closing

Congratulations. A Bank that BoeFly referred your PPP loan application to has secured an SBA authorization (an E-Tran number). You will be hearing from them directly re: closing and funding of the loan. The bank has 10 business days to finalize your loan, and they will need much of that time given their volume.

Withdrawn

Your application is no longer going to be processed.

BoeFly is proud to have processed $100+ million in loans to help small businesses fight for survival during the pandemic. Despite our success in processing these loans, we’re frustrated and disappointed that not every application received was approved prior to the funds being depleted. We know this is a major disappointment as you work to keep your businesses afloat.

There have been many unexpected challenges in the implementation of the Payroll Protection Program (PPP). When the PPP was enacted, we encouraged clients to begin pre-applying to get in line until the Small Business Administration (SBA) issued its guidance to banks for how to handle PPP loans. This was meant to help you begin gathering the documents and information that would be needed for the application process. This preparation was based on the initial PPP loan application from the SBA. However, on the evening of April 2 — the night before business owners could officially begin submitting applications — the SBA amended the application. So many small business owners rushed to submit revised applications, and BoeFly and our lending partners had to adjust our processes, too.

Banks were given only a few weeks to retool their operations to prepare for a huge influx of SBA loan applications, as this was not something they were inherently set up to do. Additionally, some banks opted to only accept applications from businesses with whom they have existing lending relationships — adding another obstacle for small business owners. BoeFly has tried to be diligent in communicating these kinds of updates daily so that we can help you make the right decisions for your business.

We will be continually updating this FAQs page as we learn new information about the possible next round of PPP funding. When additional funds become available, we will reach out immediately.

During the first round of PPP funding, BoeFly is proud to have processed thousands of applications accounting for hundreds of millions of dollars in loans to help small businesses continue to pay their employees. Despite our success in processing these loans, we’re frustrated and disappointed that not every application received was approved prior to the funds being depleted. We know this is a major disappointment as you work to keep your businesses afloat.

On April 27, 2020, banks began processing additional PPP loans using the $320 billion in aid that the President signed into law the week prior. BoeFly has successfully started processing loans again for those in the applicant pool and also added several lenders – some exclusive to us – in an effort to help as many small businesses as possible.

Experts are predicting that this second round of funds will be depleted quickly. As such, we continue to support submitting applications with multiple lenders, specifically your existing local bank or another community lender given that 20 percent of PPP2 funds will move through smaller financial institutions. Regardless, BoeFly will continue working to process all loans in our system until we learn you've secured funding elsewhere. We ask to be notified if you do receive funds in your bank so that we can pull your application and allow our lending partners to move on to another small business owner.

If you were one of the small businesses that did receive an approval notice, the lender that approved your application will contact you directly to handle the next steps in coordinating disbursement of funds. An email will be sent directly from the bank with closing documents and directions on signing.

No. While we encourage you to contact any banks you have existing lending relationships with or otherwise feel you might have success with when applying directly for a PPP loan, we recommend keeping your application in our pool for when additional stimulus funds become available. Given the volume of BoeFly loans approved in the days before the fund was depleted, we think we will similarly be well positioned to help thousands of more business owners. We also have spoken to additional lending partners that stand ready to process applications in our system that have yet to secure approval. If you were one of the small businesses that did receive an approval notice, the lender that approved your application will contact you directly to handle the next steps in coordinating disbursement of funds. All applicants can log in to the portal to see their current status.

Your bank may or may not be able to process your application faster, as they likely have their own pool of applicants waiting to receive loan approval during the second round of funding. If you have received SBA authorization (i.e., an E-Tran number) elsewhere, we ask that you notify us at support@boefly.com. We caution you from withdrawing your application with your BoeFly lender unless you have full certainty that you have been SBA authorized as opposed to being simply approved by a bank.

We will be continually updating this FAQs page as we learn new information about the possible next round of PPP funding. If and when additional funds become available, we will reach out to the BoeFly applicants that are still waiting on loan approval.

To withdraw your application from the BoeFly portal, please log in to your account and click the withdraw icon (-) for your application, under the action column. If there is no withdraw icon in your account, please email your request to support@boefly.com.

Additionally, if you have received SBA authorization (i.e., an E-Tran number) elsewhere, we ask that you notify us at support@boefly.com. We caution you from withdrawing your application with your BoeFly lender unless you have full certainty that you have been SBA authorized as opposed to being simply approved by a bank.

Indication that an E-Tran number has been assigned to your EIN is good news. In all likelihood, your loan received SBA authorization by one of our bank partners (assuming BoeFly was the only other place besides your local bank where you submitted an application). All of BoeFly’s lending partners remain fully engaged in securing additional SBA authorizations; therefore, we haven't received the real-time updates that would enable us to specifically identify the lender that secured the E-Tran. As we receive information, we'll update your status on the Portal and advise you of the status change.

After your loan application is received by a bank, expect that funds will be disbursed within 10 business days of getting the formal SBA Authorization.

No. Despite the CARES Act stipulating a 10-business-day period between SBA approval and fund disbursement, many banks are struggling to process the volume they have within this time constraint. It does not mean you will not get your money. It means it just may take beyond those 10 business days.

Lenders are working diligently through their closing processes, but due to the heavy traffic and volume of loans, it is often taking them the full period of 10 business days. BoeFly is working with lenders to provide better insight into when borrowers, like you, should be raising their hands if they haven't yet heard from the bank.

Most likely, yes. Many of BoeFly’s lenders work with servicing partners to underwrite and process their PPP loan applications. As such, it is important that you take the actions prescribed in these emails so that your PPP loan can be funded. Many, if not most, of these emails will reference BoeFly so as to confirm they are working with us.

Once your loan has been assigned to a bank partner, you should expect that they will contact you directly or via one of their processing partners to handle the next steps.

First, congratulations that you are one step closer to obtaining your PPP loan! If you were one of the small businesses that did receive an approval notice, your lender will contact you directly to handle the next steps in coordinating disbursement of funds. An email will be sent directly from the bank with closing documents and directions on signing. Lenders have 10 business days to finalize the disbursement of loans.

In addition, your application status within the portal will shift from Lender Approved (Pending SBA Authorization) to SBA Approved.

Please do not contact the lender or BoeFly directly, as they are working as quickly as possible to finalize your loans. At BoeFly, our main focus right now is to get the loan applications to banks. Providing each applicant with the bank information that they’ve been assigned, prior to the lender contacting the applicant, would delay others.

BoeFly only partners with FDIC-insured banks and SBA-approved lenders from around the country that are able to distribute funds for the PPP loan application. If you want to learn more about the specific bank that is processing your loan, please visit their website for more information.

For PPP loans, BoeFly will only partner with FDIC-insured banks – search the FDIC Institution Directory here – and SBA-approved lenders, which their list of lenders is searchable by location. The bank that you are matched with could be in any location, as long as they fall into one of those two categories, meaning they are able to distribute funds for PPP loan application.

As BoeFly works to process loans for our applicants, we've experienced lenders responding with loan amounts below the total applicants have applied for. This is occurring as small business owners have calculated average monthly payroll differently than the lenders willing to process the loans. It also has occurred in instances where the average monthly payroll that the lender is able to verify based on the supporting documentation provided is different than the number presented on the application. We understand this is frustrating. The borrower will have to decide if they want to accept the funding amount or reapply.

- BoeFly will notify you via email that your loan application has gone to a bank.

- The applicant’s lender will contact the applicant to confirm approval or request additional information to process the loan. Please note that we do not know the time expected between our alert and when the applicant will be contacted by the bank.

- As part of that process, the lender may ask applicants to open an account at that bank to support the loan disbursement. In other cases, the bank will ask for additional information, consistent with their regulatory requirements while not requiring a new account to be opened.

- The bank will follow their own origination and closing process for your loan, including updates on your loan process.

- Expect that funds will be disbursed within ten days of getting the formal bank approval.

The most important documentation to ensure processing of your PPP loan request is appropriate payroll verification. A 2019 Full Year or Trailing Twelve Month CARES report from a payroll provider (e.g., ADP/Paychex/Other) is the ideal documentation for this purpose. If this is not available, then one of the following AND 2019 W-2s that support no individual payroll or employee payroll over $100,000 are required:

- Previous 4 quarterly IRS Form 941s or Annual 940

- Annual Tax Return (last year filed)

If you are a partnership, independent contractor, or a sole proprietor, then your 2019 Tax Return will be necessary.

If not already uploaded, absence of the following documents may have caused the lender flag:

- Articles of Incorporation or Bylaws

- 2019 Employer Paid Medical Benefits and any 401K Contributions

On occasion, lenders flag files for lacking 2019 payroll documentation despite it not being possible to provide (for example, if the company began in 2020). In cases like this, ensure the documentation provided is accurate, and upload an additional PDF document explaining why your file is complete as is.

In all instances where you've been notified that your file has been flagged, your application status within the portal will be adjusted to In Progress, which will allow you to recertify and resubmit your application with adjusted documentation. This will not adversely impact your loan status with the lender.

No, unfortunately. Due to the time constraints provided by the SBA, lenders are required to close your loan within 10 days of your SBA authorization, and therefore more time cannot be granted. If you do not want to proceed, please reply back to the bank that you are withdrawing your application.

Unfortunately, once an application status is changed to Lender Submitted, applications cannot be edited. The same is true for Lender Approved (Pending SBA Authorization) and SBA Approved statuses.

Each lender will have a different system for processing PPP loans, which may or may not be automated and therefore may or may not allow for direct communication to ask questions or discuss individual loans. Information about this should be available from the lender upon their direct engagement.

BoeFly, in partnership with select lending partners, has designed an online application. You will need to provide documentation in support of the average monthly payroll costs that drives your loan amount. Currently, you should be prepared to share some or all of the documentation below (depending on your business). Your secure BoeFly portal application will let you know if there is any further documentation needed.

Note: Not ALL documents are needed for every applicant (instructions are in the Portal). Date of Birth (DOB) for each owner entry is required, and a Driver’s License (image of front and back) or other government-issued identification is required for each 25% or more owner.

Employers with payroll only (no independent contractors or sole proprietors):

One item only is needed from the list below:

- The preferred option is the CARES file from your payroll provider. ADP and Paychex both have pre-prepared reports that present eligible data, or

- An IRS Form 940 for full year 2019, or

- All 4 IRS quarterly Form 941s (Only needed if Form 490 is not available)

If you were not in business by Jan. 1, 2019, provide your payroll runs from Jan. and Feb. 2020. You must have had employees on Feb. 15, 2020, to be eligible.

ONLY INCLUDE owner’s draw if it’s on your payroll report, or income noted on Schedule K-1 or Schedule C, depending upon how the entity is structured, up to $100,000 annualized is eligible to be counted in the calculation. Owner draws, distributions, and loans to shareholders who are not subject to payroll or self-employment tax are not eligible.

DO NOT INCLUDE 1099 contractors in your employee compensation – this field in the portal is only to be used by those who are self-employed (independent contractors and sole proprietors) who file for themselves. Employers cannot include independent contractors as employee compensation.

Employers or 1099 contractors/sole proprietors with other benefits:

- If you want other benefits included, provide information for healthcare (e.g., monthly statements), retirement benefits (monthly statements from the provider).

Independent contractor:

- All 1099s received for 2019

Independent contractor:

- If 2019 taxes were filed (Schedule C)

- If 2019 is not filed, P&L for 2019

All of your supporting documents should be PDFs.

For additional SBA and Treasury guidance, the Treasury Department has created a link to their own FAQ document to address specific borrower and lender questions concerning the implementation of the PPP, and it will be updated on a regular basis.

Once an application status is changed to Lender Submitted, Lender Approved (Pending SBA Authorization) or SBA Approved it cannot be edited, as the loan application has been received by a bank for processing.

To make changes to an application that has the status of Submitted, In-Progress or Created, log into the secure portal application. You will have to unlock your application to edit information or upload new documentation.

How to unlock submitted PPP applications:

- Watch this short how-to video

- Log in

- Go to your home page, review your submitted application with the view icon

- If it needs to be corrected or updated with documentation, then:

- Click the lock icon for your app

- Confirm you wish to unlock, then click the edit (pencil) icon

- Review each section carefully, including documents, then resubmit and e-sign

To update owner information, like Driver’s License or Date of Birth (DOB), follow the same process above, then navigate to the owner’s section, select edit, update the percent ownership, and ensure the DOB is correct. If the ownership is more than 25%, you will be prompted to upload a Driver’s License. You can always upload copies of the Driver’s License on the documents page as well.

The NAICS code is required on the PPP application. Watch this video for simple instructions to find and add the NAICS code.

Watch this video for simple instructions on how to edit your in-progress application on the BoeFly portal.

Watch this video for simple instructions on how to add an owner to a business application on the BoeFly PPP Portal.

As banks are processing loans, they have run into several instances where an individual loan has already been assigned an E-Tran authorization in SBA’s system by another lender. We have supported our applicants submitting their PPP applications with multiple lenders, and in some cases, E-Tran authorization has been assigned through an alternate bank, and they have not withdrawn their application from our BoeFly system. It is important to our lenders that we send through applications that have not been assigned an E-Tran authorization so that they can successfully process as many loans as possible during PPP2.

There are some instances where we have decided to pivot loan applications from one BoeFly lender to another in an effort to expedite SBA approval. Status updates in the portal have oftentimes adjusted in connection with this. Do not be alarmed; status updates in the portal are often delayed due to feedback from our lending partners being delayed itself.

All of BoeFly’s lending partners remain fully focused on processing as many PPP applications as possible. Due to the nature of the SBA’s online authorization system (E-Tran), there has been a backlog of pushing approvals through. As such, the status updates in the BoeFly portal may be significantly delayed as they are dependent on BoeFly receiving details from our lending partners.

On April 30th, BoeFly sent an email to applicants that asks for their quick response to the question “Are you still in need of a PPP loan?” In order to expedite the process, make sure you respond.

The eight-week period begins on the date the lender makes the first disbursement of the PPP loan to the borrower.

View the Loan Forgiveness Webinar here, and learn the most important tips to maximize your loan forgiveness.

All businesses – including nonprofits, veterans’ organizations, tribal business concerns, sole proprietorships, self-employed individuals, and independent contractors – with 500 or fewer employees can apply. Businesses in certain industries can have more than 500 employees if they meet applicable SBA employee-based size standards for those industries.

For this program, the SBA’s affiliation standards are waived for small businesses (1) in the hotel and food services industries; or (2) that are franchises in the SBA’s Franchise Directory; or (3) that receive financial assistance from small business investment companies licensed by the SBA. Additional guidance may be released as appropriate.

For additional SBA and Treasury guidance, the Treasury Department has created a link to their own FAQ document, to address specific borrower and lender questions concerning the implementation of the PPP, that will be updated on a regular basis.

You are eligible for a PPP loan if:

- you were in operation on February 15, 2020;

- you are an individual with self-employment income (such as an independent contractor or a sole proprietor);

- your principal place of residence is in the United States;

- and you filed or will file a Form 1040 Schedule C for 2019.

However, if you are a partner in a partnership, you may not submit a separate PPP loan application for yourself as a self-employed individual. Instead, the self-employment income of general active partners may be reported as a payroll cost, up to $100,000 annualized, on a PPP loan application filed by or on behalf of the partnership.

Partnerships are eligible for PPP loans under the Act, and the Administrator has determined, in consultation with the Secretary of the Treasury (Secretary), that limiting a partnership and its partners (and an LLC filing taxes as a partnership) to one PPP loan is necessary to help ensure that as many eligible borrowers as possible obtain PPP loans before the statutory deadline of June 30, 2020. This limitation will allow lenders to more quickly process applications and lessen the burdens of applying for partnerships/partners.

For additional guidance as an individual with self-employed income, please review the new interim final rule, issued on April 2, 2020, by the SBA, or visit their FAQs that are being updated periodically.

Your business must have been operational as of February 15, 2020, and had employees for whom you paid salaries and payroll taxes at that time or you are an individual with self-employment income (such as an independent contractor or a sole proprietor) and you filed or will file a Form 1040 Schedule C for 2019.

For businesses with employees:

Average monthly payroll costs, excluding compensation above $100,000 in wages (based on prior 12 months or from the calendar year 2019) X 2.5. That amount is subject to a $10 million cap.

In general, borrowers can calculate their aggregate payroll costs using data either from the previous 12 months or from calendar year 2019. For seasonal businesses, the applicant may use average monthly payroll for the period between February 15, 2019, or March 1, 2019, and June 30, 2019. An applicant that was not in business from February 15, 2019 to June 30, 2019 may use the average monthly payroll costs for the period January 1, 2020 through February 29, 2020.

Borrowers may use their average employment over the same time periods to determine their number of employees, for the purposes of applying an employee-based size standard. Alternatively, borrowers may elect to use SBA’s usual calculation: the average number of employees per pay period in the 12 completed calendar months prior to the date of the loan application (or the average number of employees for each of the pay periods that the business has been operational, if it has not been operational for 12 months).

Rent does not count as “payroll costs” and should not be included in your loan calculations. However, proceeds from the loan can be used for working capital.

For individuals with self-employment income (such as an independent contractor or a sole proprietor) who file a Form 1040, Schedule C:

How you calculate your maximum loan amount depends upon whether or not you employ other individuals. If you have no employees, the following methodology should be used to calculate your maximum loan amount:

- Find your 2019 IRS Form 1040 Schedule C line 31 net profit amount (if you have not yet filed a 2019 return, fill it out and compute the value). If this amount is over $100,000, reduce it to $100,000. If this amount is zero or less, you are not eligible for a PPP loan.

- Calculate the average monthly net profit amount (divide the amount from Step 1 by 12).

- Multiply the average monthly net profit amount from Step 2 by 2.5.

- Add the outstanding amount of any Economic Injury Disaster Loan (EIDL) made between January 31, 2020 and April 3, 2020 that you seek to refinance, less the amount of any advance under an EIDL COVID-19 loan (because it does not have to be repaid). Regardless of whether you have filed a 2019 tax return with the IRS, you must provide the 2019 Form 1040 Schedule C with your PPP loan application to substantiate the applied-for PPP loan amount and a 2019 IRS Form 1099-MISC detailing nonemployee compensation received (box 7), invoice, bank statement, or book of record that 7 establishes you are self-employed. You must provide a 2020 invoice, bank statement, or book of record to establish you were in operation on or around February 15, 2020.

If you have employees, the following methodology should be used to calculate your maximum loan amount:

- Compute 2019 payroll by adding the following:

- Your 2019 Form 1040 Schedule C line 31 net profit amount (if you have not yet filed a 2019 return, fill it out and compute the value), up to $100,000 annualized, if this amount is over $100,000, reduce it to $100,000, if this amount is less than zero, set this amount at zero;

- 2019 gross wages and tips paid to your employees whose principal place of residence is in the United States computed using 2019 IRS Form 941 Taxable Medicare wages & tips (line 5c- column 1) from each quarter plus any pre-tax employee contributions for health insurance or other fringe benefits excluded from Taxable Medicare wages & tips; subtract any amounts paid to any individual employee in excess of $100,000 annualized and any amounts paid to any employee whose principal place of residence is outside the United States; and

- 2019 employer health insurance contributions (health insurance component of Form 1040 Schedule C line 14), retirement contributions (Form 1040 Schedule C line 19), and state and local taxes assessed on employee compensation (primarily under state laws commonly referred to as the State Unemployment Tax Act or SUTA from state quarterly wage reporting forms).

- Calculate the average monthly amount (divide the amount from Step 1 by 12).

- Multiply the average monthly amount from Step 2 by 2.5.

- Add the outstanding amount of any EIDL made between January 31, 2020 and April 3, 2020 that you seek to refinance, less the amount of any advance under an EIDL COVID-19 loan (because it does not have to be repaid). You must supply your 2019 Form 1040 Schedule C, Form 941 (or other tax forms or equivalent payroll processor records containing similar information) and state quarterly wage unemployment insurance tax reporting forms from each quarter in 2019 or equivalent payroll processor records, along with evidence of any retirement and health insurance contributions, if applicable. A payroll statement or similar documentation from the pay period that covered February 15, 2020 must be provided to establish you were in operation on February 15, 2020.

- Salaries (up to $100,000* for any employee), wages, commissions or similar compensation, cash tips or equivalent, paid vacations, paid sick, parental and family medical leave

- Allowance for dismissal or separation

- Group health costs including insurance premiums

- Retirement benefits

- State and local payroll taxes

Any amounts that an eligible borrower has paid to an independent contractor or sole proprietor should be excluded from the eligible business’s payroll costs. However, an independent contractor or sole proprietor will itself be eligible for a loan under the PPP, if it satisfies the applicable requirements.

Rent does not count as “payroll costs” and should not be included in your loan calculations. However, proceeds from the loan can be used for working capital.

* The exclusion of compensation more than $100,000 annually applies only to cash compensation, not to non-cash benefits, including:

- employer contributions to defined-benefit or defined-contribution retirement plans;

- payment for the provision of employee benefits consisting of group health care coverage, including insurance premiums; and

- payment of state and local taxes assessed on compensation of employees.

No. Any amounts that an eligible borrower has paid to an independent contractor (1099 employee) or sole proprietor should be excluded from the eligible business’s payroll costs. However, an independent contractor or sole proprietor will itself be eligible for a loan under the PPP, if it satisfies the applicable requirements.

Under the Act, payroll costs are calculated on a gross basis without regard to (i.e., not including subtractions or additions based on) federal taxes imposed or withheld, such as the employee’s and employer’s share of Federal Insurance Contributions Act (FICA) and income taxes required to be withheld from employees.

As a result, payroll costs are not reduced by taxes imposed on an employee and required to be withheld by the employer, but payroll costs do not include the employer’s share of payroll tax. For example, an employee who earned $4,000 per month in gross wages, from which $500 in federal taxes was withheld, would count as $4,000 in payroll costs. The employee would receive $3,500, and $500 would be paid to the federal government. However, the employer-side federal payroll taxes imposed on the $4,000 in wages are excluded from payroll costs under the statute.

Yes. You should use the proceeds from these loans on your:

- Payroll costs, including benefits;

- Interest on mortgage obligations, incurred before February 15, 2020;

- Rent, under lease agreements in force before February 15, 2020; and

- Utilities, for which service began before February 15, 2020.

- Note: SBA Disaster loans made between 1/31/20 and the date the PPP funds are available may be refinanced with a PPP loan.

For individuals with self-employment income (such as an independent contractor or a sole proprietor) who file a Form 1040, Schedule C, please review the new interim final rule, issued on April 2, 2020, by the SBA to understand how PPP loans can be used.

You will owe money when your loan is due if you use the loan amount for anything other than payroll costs, mortgage interest, rent, and utilities payments over the 8 weeks after getting the loan. Due to likely high subscription, no more than 25% of the forgiven amount may be for non-payroll costs.

You will also owe money if you do not maintain your staff and payroll.

- Number of Staff: Your loan forgiveness will be reduced if you decrease your full-time employee headcount.

- Level of Payroll: Your loan forgiveness will also be reduced if you decrease salaries and wages by more than 25% for any employee that made less than $100,000 annualized in 2019.

- Re-Hiring: You have until June 30, 2020 to restore your full-time employment and salary levels for any changes made between February 15, 2020 and April 26, 2020. If you offer to rehire and the employee declines, you will want written proof of both.

View the Loan Forgiveness Webinar here, and learn the most important tips to maximize your loan forgiveness.

No. As an exercise of the Administrator’s and the Secretary’s authority under Section 1106(d)(6) of the CARES Act to prescribe regulations granting de minimis exemptions from the Act’s limits on loan forgiveness, SBA and Treasury intend to issue an interim final rule excluding laid-off employees whom the borrower offered to rehire (for the same salary/wages and same number of hours) from the CARES Act’s loan forgiveness reduction calculation. The interim final rule will specify that, to qualify for this exception, the borrower must have made a good faith written offer of rehire, and the employee’s rejection of that offer must be documented by the borrower. Employees and employers should be aware that employees who reject offers of re-employment may forfeit eligibility for continued unemployment compensation.

View the Loan Forgiveness Webinar here, and learn the most important tips to maximize your loan forgiveness.

According to the International Franchise Association (IFA), if a franchise brand is listed on the SBA Franchise Directory, each of its franchisees that meets the applicable size standard can apply for a PPP loan. (The franchisor does not apply on behalf of its franchisees.) The $10 million cap on PPP loans is a limit per franchisee entity, and each franchisee is limited to one PPP loan.

Franchise brands that have been denied listing on the Directory because of affiliation between franchisor and franchisee may request listing to receive PPP loans. SBA will not apply affiliation rules to a franchise brand requesting listing on the Directory to participate in the PPP, but SBA will confirm that the brand is otherwise eligible for listing on the Directory.

For additional guidance, the IFA has created a link to their own FAQ document to address specific questions about the PPP and how it relates to franchising.

According to the International Franchise Association (IFA) FAQ document, under the CARES Act, any single business entity that is assigned an NAICS code beginning with 72 (including hotels and restaurants) and that employs not more than 500 employees per physical location is eligible to receive a PPP loan.

In addition, SBA’s affiliation rules (13 CFR 121.103 and 13 CFR 121.301) do not apply to any business entity that is assigned an NAICS code beginning with 72 and that employs not more than a total of 500 employees. As a result, if each hotel or restaurant location owned by a parent business is a separate legal business entity, each hotel or restaurant location that employs not more than 500 employees is permitted to apply for a separate PPP loan provided it uses its unique EIN.

The $10 million maximum loan amount limitation applies to each eligible business entity because individual business entities cannot apply for more than one loan. The following examples illustrate how these principles apply.

Example 1. Company X directly owns multiple restaurants and has no affiliates.

- Company X may apply for a PPP loan if it employs 500 or fewer employees per location (including at its headquarters), even if the total number of employees employed across all locations is over 500.

Example 2. Company X wholly owns Company Y and Company Z (as a result, Companies X, Y, and Z are all affiliates of one another). Company Y and Company Z each own a single restaurant with 500 or fewer employees.

- Company Y and Company Z can each apply for a separate PPP loan because each has 500 or fewer employees. The affiliation rules do not apply because Company Y and Company Z each have 500 or fewer employees and are in the food services business (with a NAICS code beginning with 72).

Example 3. Company X wholly owns Company Y and Company Z (as a result, Companies X, Y, and Z are all affiliates of one another). Company Y owns a restaurant with 400 employees. Company Z is a construction company with 400 employees.

- Company Y is eligible for a PPP loan because it has 500 or fewer employees. The affiliation rules do not apply to Company Y because it has 500 or fewer employees and is in the food services business (with a NAICS code beginning with 72).

- The waiver of the affiliation rules does not apply to Company Z because Company Z is in the construction industry. Under SBA’s affiliation rules, 13 CFR 121.301(f)(1) and (3), Company Y and Company Z are affiliates of one another because they are under the common control of Company X, which wholly owns both companies. This means that the size of Company Z is determined by adding its employees to those of Companies X and Y. Therefore, Company Z is deemed to have more than 500 employees, together with its affiliates. However, Company Z may be eligible to receive a PPP loan as a small business concern if it, together with Companies X and Y, meets SBA’s other applicable size standards,” as explained in FAQ #2.

There are no SBA fees; bank fees (including guarantee fee); or fees paid to BoeFly.

No personal guarantee; no collateral requirements.

1% fixed rate for a 2-year term. Principal and interest payments on the loan will be deferred for 6 months up to 12-months.

The majority of lenders can’t handle the high volume of loan applications, and this could delay getting you your money. Banks are unsettled and the pressure is intense on all parties, not to mention that banks are in crisis mode with COVID-19, just like you. BoeFly is continuing to work closely with both community banks and large national banks as they come online to process PPP loans. We process with an array of lenders of all sizes, working with those that can work with technology and are OK with the economics, showing that they are not avoiding the program.

How banks execute will be critical.

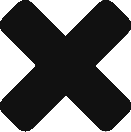

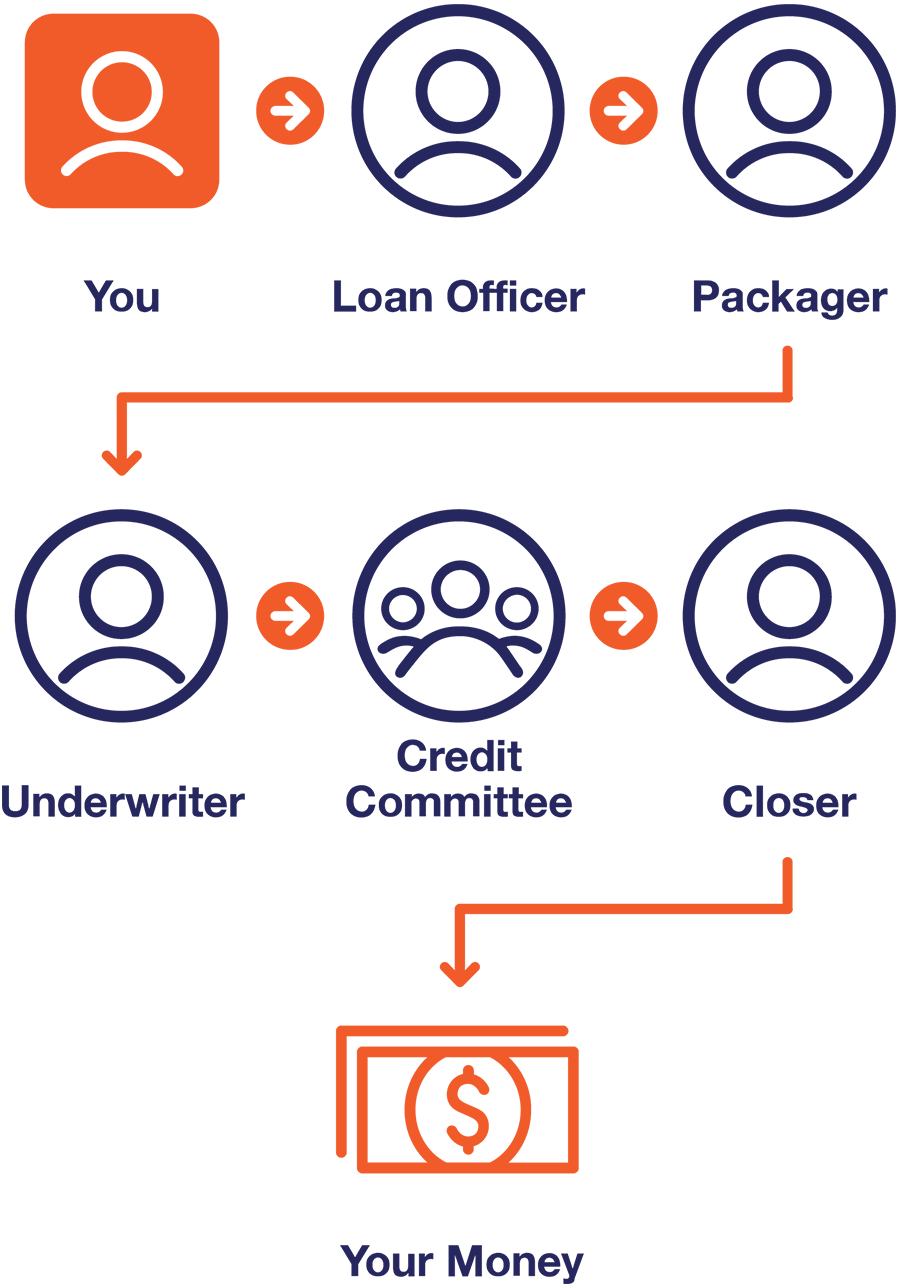

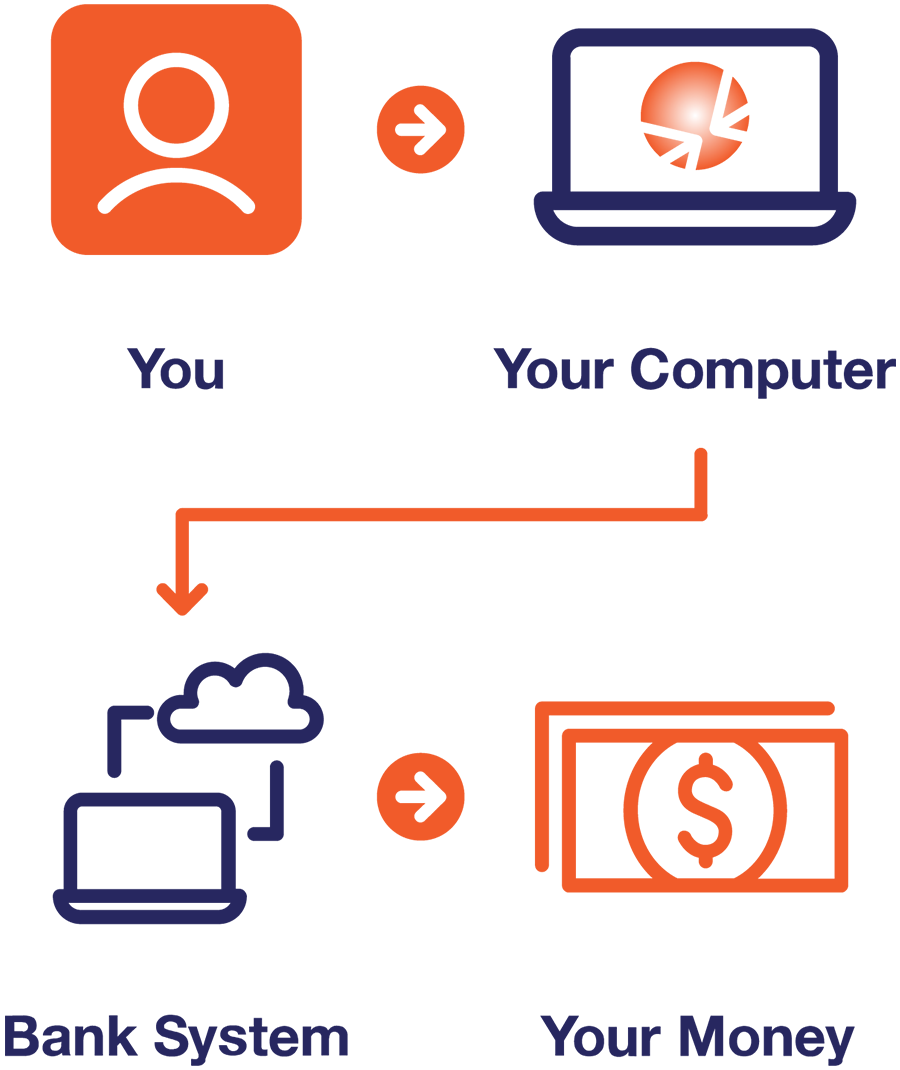

Will banks use their 'normal process' relying on people and manual steps?

Will banks use the tech-driven process and focus on speed?

If you expect you will get a loan from a bank because you meet their criteria, you can still move forward with their process, and we’ll also keep processing for you unless you get your authorization elsewhere.

If you expect you will get a loan from a bank because you meet their criteria, you can still move forward with their process, and we’ll also keep processing for you unless you get your authorization elsewhere.

No, an application is not an SBA authorization. SBA authorization will occur when you are assigned an Electronic Loan Processing (E-Tran) number. This means your funds are reserved, but technically, an E-Tran is an SBA loan guaranty origination/servicing solution that:

- Leverages internet technology to reduce the turnaround time on loan guaranty requests.

- Is integrated into your SBA software products and enables you to submit electronically from your existing screens.

- Provides increased efficiency and decreased costs in the loan guaranty origination and servicing processes.

The time from authorization to funding may vary widely.

You can take out a PPP loan and an SBA Disaster Relief Loan (EIDL) only IF the EIDL loan is used for purposes other than what’s covered by the PPP loan. Given the unique forgiveness aspect of the PPP, borrowers are advised to take the endeavor to secure a PPP loan. Borrowers with an EIDL loan unrelated to COVID-19 are still eligible.

- EIDL is available in states subject to a Disaster Declaration.

- Business must have been in operation on 1/31/20.

- Proceeds can be used to pay payroll, fixed debts, accounts payable, and other bills. If you apply for a PPP loan, you cannot use EIDL proceeds for the same purposes, but you can get an EIDL loan for other purposes.

- Loans under EIDL may be refinanced into a PPP loan. In addition, if you apply for an EIDL, you can get a $10,000 advance while the application is pending, which does not have to be repaid if your application is denied. If you get the $10,000 advance and then get a PPP loan, the $10,000 will be deducted from the amount of the PPP loan forgiven.

PPP loans are being overseen by SBA, but that is where the similarities stop. PPP loans can be forgiven, have more borrower-friendly terms like no personal guarantee, and are less cumbersome and restrictive.

No, you do not need to complete that form. Instead, the documentation that you provide to BoeFly in your secure portal will be completing the necessary information found on that form.

At BoeFly, we pride ourselves on quick response times and providing excellent customer service. However, with the extremely high volume of PPP loan applicants, we cannot at this time respond to all direct inquiries while still being able to process as many loan applications as possible - which is currently our number one priority. Once you complete your application, you will receive ongoing communications from BoeFly with timely updates from the SBA and lenders. We urge you to utilize this robust FAQ page to try and locate the answer to your inquiry.

You will need to submit an application for forgiveness to your lender, including documentation verifying the number of full-time equivalent employees and pay rates for the 8-week or 24-week period commencing when the loan is made. The documentation should include payroll tax filings with the IRS, state and local income, payroll, and unemployment insurance filings, cancelled checks, payment receipts, or other documents verifying payments. You will need to certify that the documentation is true and correct and that the amount of the requested forgiveness was used for the permitted purposes. The amount forgiven will be reduced to the extent that there was a reduction in the number and/or salaries of employees, unless restored by June 30, 2020.

For individuals with self-employment income (such as an independent contractor or a sole proprietor) who file a Form 1040, Schedule C, please review the new interim final rule issued on April 2, 2020, by the SBA to understand what amounts shall be eligible for forgiveness.

View the Loan Forgiveness Webinar here, and learn the most important tips to maximize your loan forgiveness.

BoeFly's PPP portal was rolled out with extreme speed as we tried to keep track with the new developments and guidance coming from Treasury and the SBA since the program began. As such, there may be a few glitches yet to be resolved. In instances where you may be experiencing login issues, be sure to manually key in every character in all fields, including your username AND password (i.e., do NOT rely on saved information your browser may use to pre-populate fields for you even if it appears to be populated for you. You will need to delete it and rekey the information, and do not auto-select a saved option.) Please note, login information is case sensitive.

Despite this appearance, rest assured the data was collected even if not presented on the summary page after submitting. No further action is required.

No. Providing an accurate calculation of payroll costs is the responsibility of the borrower, and the borrower must attest to the accuracy of those calculations. Lenders are expected to perform a good faith review, in a reasonable time frame, of the borrower’s calculations and supporting documents concerning average monthly payroll cost. The level of diligence by a lender should be informed by the quality of supporting documents supplied by the borrower. Minimal review of calculations based on a payroll report by a recognized third-party payroll processor, for example, would be reasonable.

If lenders identify errors in the borrower’s calculation or material lack of substantiation in the borrower’s supporting documents, the lender should work with the borrower to remedy the error.

No. It is the responsibility of the borrower to determine which entities (if any) are its affiliates and determine the employee headcount of the borrower and its affiliates. Lenders are permitted to rely on borrowers’ certifications.

Yes. Borrowers must apply the affiliation rules set forth in SBA’s Interim Final Rule on Affiliation. A borrower must certify on the Borrower Application Form that the borrower is eligible to receive a PPP loan, and that certification means that the borrower is a small business concern as defined in section 3 of the Small Business Act, meets the applicable SBA employee-based or revenue-based size standard, or meets the tests in SBA’s alternative size standard, after applying the affiliation rules, if applicable.

Yes. Please direct the local bank to our lender’s page to submit their information and connect with BoeFly to learn more about how our technology can help them streamline their processing of PPP loans.